Posts

- Atlanta casino bonus withdrawal rules: Wall Street financial institutions put 30 billion to rescue Basic Republic

- Accounts Receivable against. Membership Payable: What’s the Change?

- Alphabet’s Quantum Plunge: Inventory Soars Past AI Tincture

- The newest 12 Greatest A house Using Apps in the 2024 (A house Crowdfunding Websites)

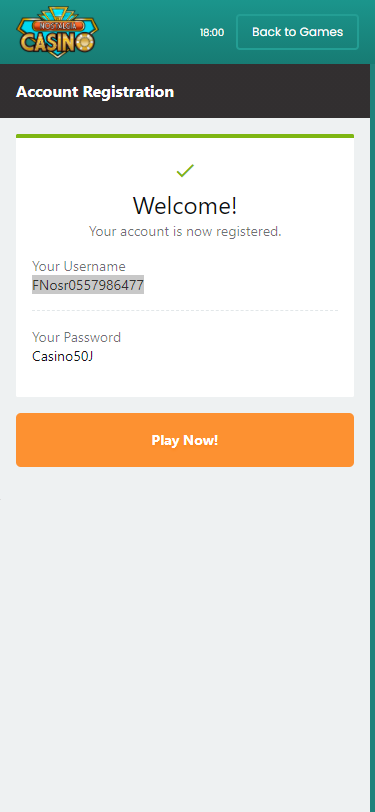

UBS’s Leader Sergio Ermotti has said he aims to score straight back the credit Suisse assets. “As it is preferred in the business, there can be specifically tailored also provides that can as well as confidence an overall buyer relationship,” Credit Suisse said in response so you can an ask for remark. CoinCodex tracks 38,000+ cryptocurrencies to the 200+ transfers, offering live cost, price forecasts, and you will economic systems to have crypto, brings, and you will forex investors. Wall Road Memes Casino’s promotions ensure it is pages so you can kickstart their gambling enterprise journey to the right foot. You merely unlock a WSM Gambling establishment membership, therefore’ll prepare yourself very quickly. As well as cryptocurrency fee options, WSM Gambling enterprise supports old-fashioned fee tips too, in addition to Charge and Credit card.

Atlanta casino bonus withdrawal rules: Wall Street financial institutions put 30 billion to rescue Basic Republic

“With lead deposits exceeding 5,000 monthly, a wide range of options and you may commitments open, which, whenever handled astutely, is fortify debt health and coming balance,” Shirshikov remarked. Optimism is within purchase, since the pros to ensure us one to a proper means can change it monetary milestone to the a good launchpad to own wealth buildup. Based on Andy Chang, founder of your Borrowing from the bank Opinion, that it raised earnings level can be pave the way not only to possess economic government however for active wide range growth. Hide is actually another form of money program one wants to help enable one to invest from the simplifying the brand new money techniques and making it easier as an investor.

Accounts Receivable against. Membership Payable: What’s the Change?

- Nothing you’ve seen prior have most the newest panel tried to prevent the newest president to follow their own agenda.

- Ben Emons, lead away from fixed income to own NewEdge Money, listed one banking companies trading for less than 5 a percentage are detected from the locations to be at risk for bodies seizure.

- It privately funneled 2.5 trillion in the low-cost revolving financing in order to Citigroup from December 2007 due to at the very least July 2010.

Ranging from 1998 and 2006, the cost of the typical Western family enhanced from the 124percent.298 Inside the 1980s and you may 1990s, the fresh national average home price varied away from dos.9 to three.step 1 minutes average family earnings. By contrast, which ratio risen to cuatro.0 inside 2004, and you can 4.six inside 2006.299 Which houses ripple resulted in of numerous people refinancing their houses during the lower interest rates, otherwise financing individual investing by using away 2nd mortgages safeguarded because of the the price love. Helps corporation consumers, along with Robinhood, Brex and Rectangular, be sure their users’ identities and you may follow regulatory standards.

In her own 2012 guide, Bull from the Horns, Bair produces an astounding revelation from the Citigroup. Regardless of Atlanta casino bonus withdrawal rules the trillions of cash inside the revolving money and investment infusions always prop upwards Citigroup inside 2007 to 2010 economic drama, their federally-covered commercial financial, Citibank, in fact held just 125 billion inside the U.S. insured places according to Bair. To your October step three, Congress introduced the fresh 800 billion Disaster Financial Stabilization Act, and this subscribed the new Treasury Agency to buy troubled assets and you can bank brings. Combined, the fresh initiatives, combined with actions consumed different countries, concluded the fresh bad of your Great Market meltdown by middle-2009.

By the October the brand new system got folded and Howe is actually charged with several counts away from fraud.ten She try found guilty and you can offered 36 months within the prison. With regards to the FDIC, the brand new Deposit Insurance coverage Finance (DIF) kept 128.2 billion as of December 29, 2022 because the overall from home-based deposits tallied to 17.7 trillion. During the time, some experts have been comforted from the actions NYCB got in order to shore right up their funding, and listed that the promotion from previous Flagstar President Alessandro DiNello to professional chairman increased believe in management generally. The lending company’s inventory are temporarily buoyed by the a good flurry from insider purchases demonstrating professionals’ believe on the bank. Months afterwards, reviews service Moody’s cut the bank’s credit scores a couple notches to junk on the questions across the financial’s exposure management potential following the deviation away from NYCB’s chief exposure administrator and you may captain review professional.

Alphabet’s Quantum Plunge: Inventory Soars Past AI Tincture

Laura Martin, a senior websites and you may media analyst at the Needham and Business, recently looked to your CNBC’s ‘Electricity Dinner’ so you can forecast and this large tech organizations you’ll take over inside 2025. Their information rely on the a variety of political impacts, scientific advancements, and proper positioning inside AI landscaping. Jelena McWilliams (née Obrenić; produced July 29, 1973)1 are a great Serbian-American business executive and you can an old president of your Federal Deposit Insurance rates Company. She are selected up to the point also to the new FDIC Panel out of Administrators from the Chairman Donald Trump, and the Senate confirmed her meeting on twenty four, 2018.dos She try pledged inside as the president for the Summer 5, 2018.

“Customers who had never invested ahead of were consistently getting already been with 5 and you can loving the fresh cellular feel and you can empowerment to become an enthusiastic investor.” As well as letting you spend money on the companies and you may sectors you to definitely mater extremely for your requirements and match your welfare and you can values, the fresh mobile app and demonstrates to you financing and you may using basics in the effortless words to help inform pages on how to purchase. The company claims it’s got more than three hundred,000 people which is incorporating on the ten,one hundred thousand the newest people weekly. I have been after the Roadways stock recommendations for some time today, as well as their understanding of NVDA (NVIDIA Firm) has been absolutely nothing lacking epic. The intricate research and you will quick reputation gave me the new believe in order to purchase NVDA, plus the results were outstanding. Due to the Street, I found myself capable exploit probably one of the most fascinating growth reports regarding the technology business.

The newest 12 Greatest A house Using Apps in the 2024 (A house Crowdfunding Websites)

Sure, there are a great number of alternatives whenever spending a big contribution of money, nevertheless the boils down to debt and you will existence desires. High-give offers profile (HYSAs) are now giving more cuatropercent APY for the deposits, with a few networks offering a lot more. However, even with 5 million, to purchase an office building was somewhat unrealistic or consume an excessive amount of your own money, so you may contemplate using an on-line crowdfunded a house platform instead.

Dependent inside 1993, The new Motley Fool is an economic functions business dedicated to to make the world smarter, happier, and you may richer. The new Motley Fool has reached huge numbers of people per month thanks to our premium using alternatives, totally free advice and you will business analysis on the Fool.com, personal money degree, top-ranked podcasts, and non-money The newest Motley Deceive Basis. Lower than government statute, the fresh places stored by the U.S. financial institutions that will be located on overseas surface are not covered because of the the brand new FDIC.